Uncompensated care is a growing threat to the health of hospitals and patients in the U.S.

When hospitals don’t receive payment from insurers or patients for the services they provide, it can cause everything from bad debt and negative operating margins to closure.

At the same time, the more patients are asked to pay, the more likely they are to delay or skip care, especially during times of inflation. That leads to worsening health conditions and higher future healthcare costs.

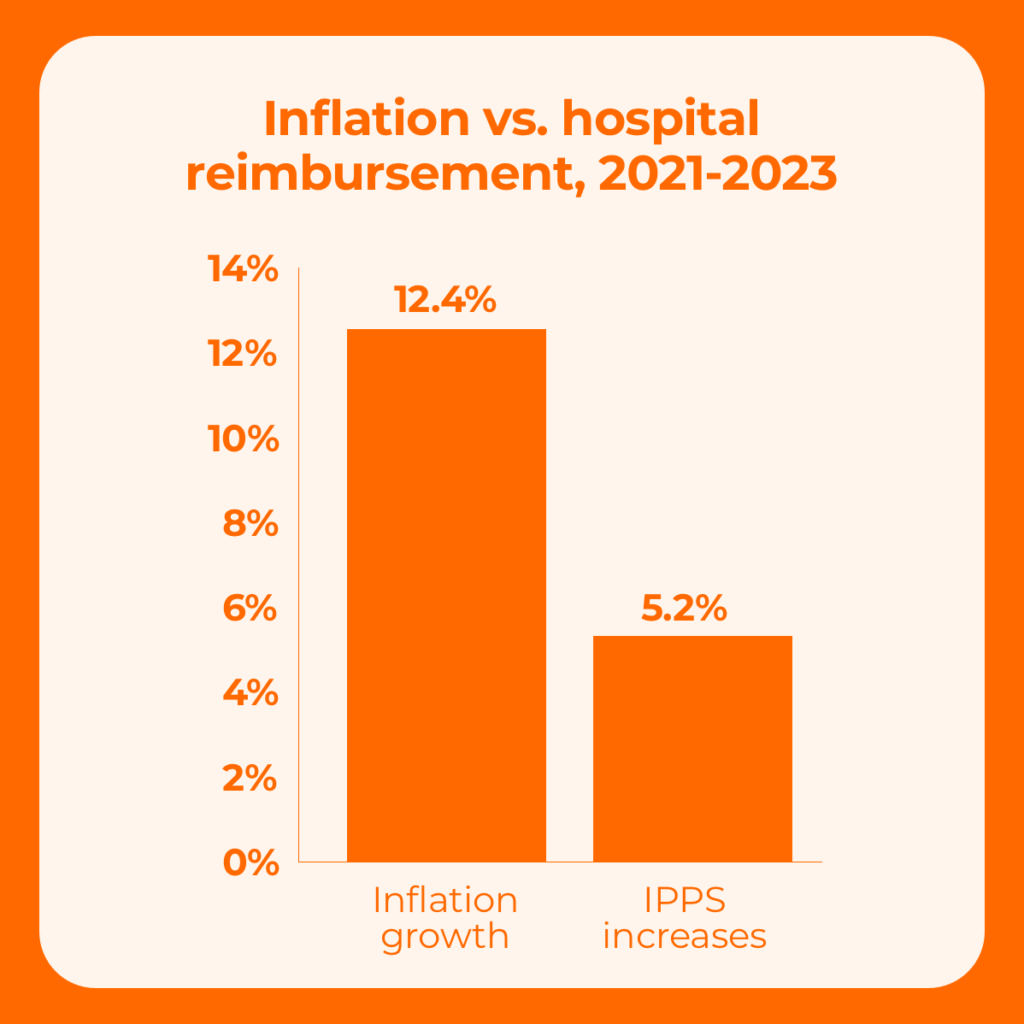

Inflation also has a dramatic, negative effect on hospitals. According to the American Hospital Association (AHA), inflation grew at more than double the rate of reimbursement under IPPS (inpatient prospective payment system).

And when all these challenges converge, it creates a cycle that’s not good for anyone.

What is the rise in uncompensated care doing to hospitals?

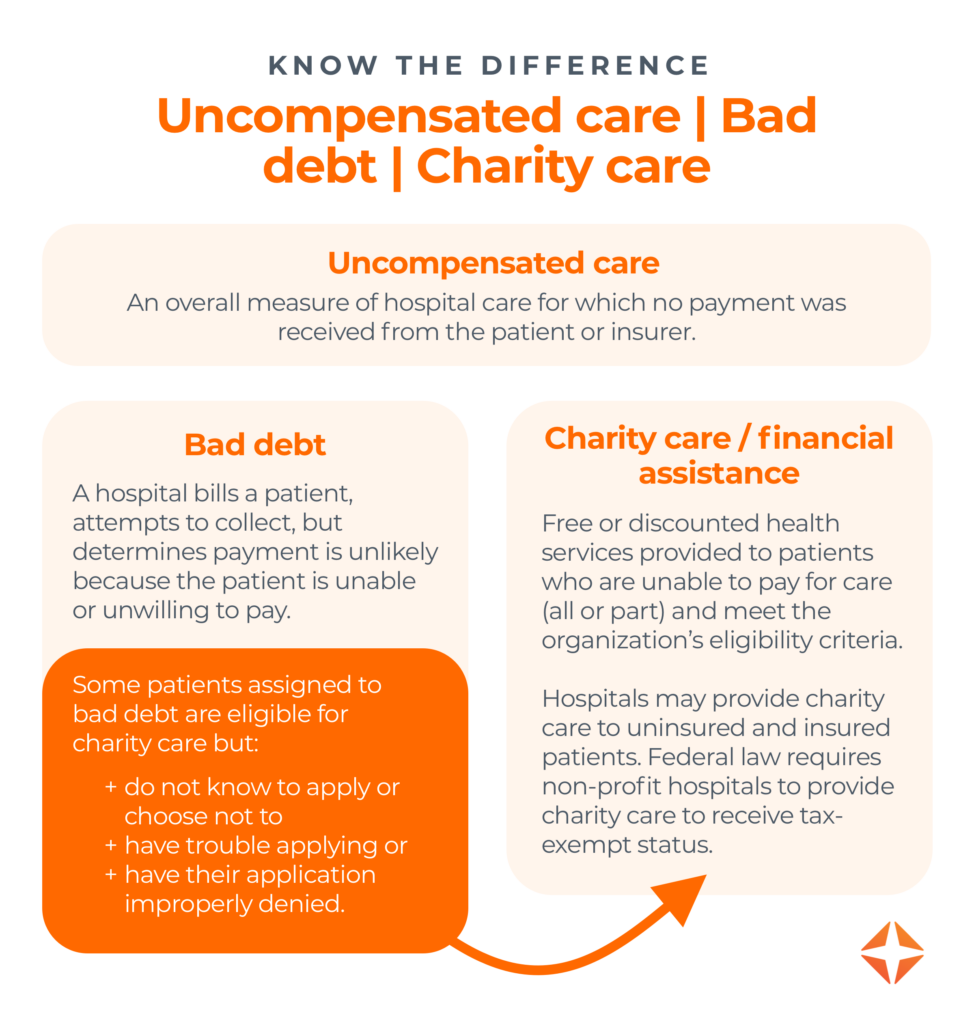

Uncompensated care, the sum of charity care and bad debt, typically comprises a small percentage of a hospital’s expenses.

In 2020, for example, half of hospitals reported charity care costs made up 1.4% or less of their total operating expenses. Naturally, this varies widely depending on size, location, mission, and population served.

Some hospitals serve larger populations of uninsured or underinsured patients, such as:

- Hospitals in urban areas

- Facilities designated as safety-net hospitals

- Rural hospitals in non-expansion states

However, in recent years, nearly all hospitals have seen uncompensated care swell as Medicaid eligibility has narrowed.

- In the first half of 2023 alone, the median rate of uncompensated care for hospitals surged from 6.4% to 8.7% — an increase of one-third in just six months.

- According to the AHA, hospitals lost almost $745 billion in uncompensated care from 2000-2020.

Between these increases, continuing changes to Medicaid, and the ongoing struggles with inflation, hospitals can’t afford to wait for a charity care solution to present itself.

Here are four steps hospitals must take now to ensure they’re on the right track.

4 ways to minimize uncompensated care + bad debt

1. Don’t rely on patients to provide accurate insurance information.

One of the first lines of defense against uncompensated care is to find active insurance patients don’t know they have. That means using a solution that automatically:

- Confirms active coverage regardless of patient’s point of entry

- Provides a high degree of control validating patient coverage

- Accesses a substantial amount of payer connections and patient data

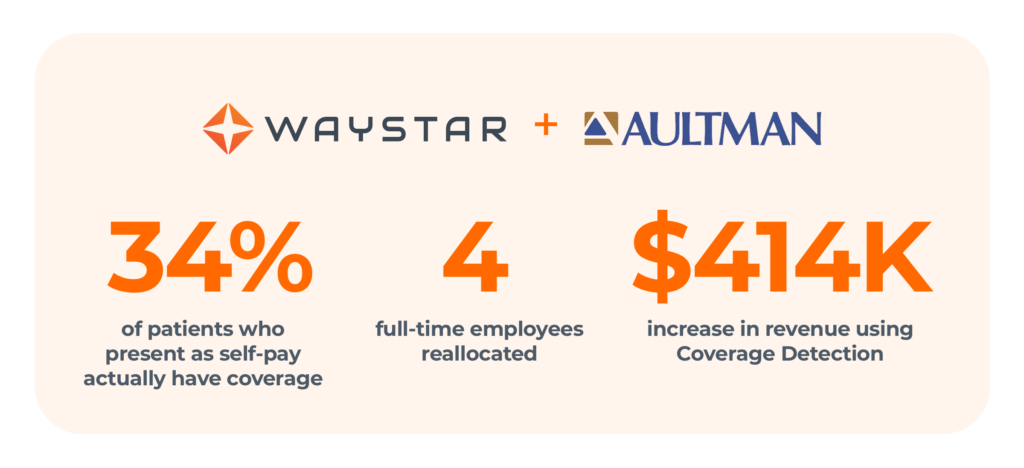

How much can this stop your bad debt from ballooning? Here’s just one example: Using Waystar’s Coverage Detection solution, Aultman Health found coverage for 34% of patients presenting as self-pay. Over 16 months, they gained $414,000 in revenue.

2. Do maintain non-profit status.

If you operate as a non-profit health system or hospital, you must comply with the requirements for 501(c)(3) hospitals under the Affordable Care Act (ACA). Failure to do this could result in penalties or the loss of non-profit status, and three of these requirements relate directly to revenue cycle operations. Make sure to:

- Establish a written Financial Assistance Policy (FAP)

- Set charge limits for FAP-eligible patients

- Make a reasonable effort to determine FAP eligibility

Financial barriers for patients who were covered by the ACA are becoming more pronounced, and many are unable to manage unexpected medical expenses. This increased financial insecurity is driving more individuals to seek charity care, and that means non-profit hospitals that provide that care must be even more diligent in doing so (and documenting it properly).

3. Don’t use credit to screen for uncompensated care.

Before you assign a patient to bad debt, it’s essential to screen patients electronically for financial assistance. However, the traditional method of screening — by credit score — is not the most effective. People living in poverty aren’t likely to be heavy credit users. Only 59% of people in low-income neighborhoods even have credit cards, which means many won’t show up on the radar of credit companies at all.

If your screening tool only uses credit score to evaluate a patient’s financial reality, your hospital will miss an enormous piece of the puzzle. Worse, when a credit-based tool comes up short because it can’t find a match in the database, it may simply return a default score, which gives you something worse than no information — it gives you incorrect information.

4. Do use socioeconomic data to screen for uncompensated care.

The most successful screening tools focus on socioeconomic data to evaluate patients. They leverage thousands of sources of data like education, income, and access to health services to determine a patient’s likelihood of qualifying for financial assistance. And they use artificial intelligence to make determinations based on your organization’s specific FAP, which means verdicts are tailored to your hospital, not someone else’s.

This yields positive results for patients and providers:

- It saves time and hassle.

Predictive modelling can prevent patients from applying for financial assistance that they won’t ultimately qualify for. - It instantly removes financial barriers for patients who need care.

This includes those who are unaware of charity care, as well as those who are unable or unwilling to apply. - It decreases hospitals’ bad debt.

By eliminating 25-40% of uncollectible accounts from bad-debt portfolios, hospitals can increase productivity and performance substantially.*

With the right solution, healthcare providers can find additional charity dollars for patients, better manage financial pressures, and improve the patient experience.

*Waystar data, 2024

Slash uncompensated care with Waystar Charity Screening

When hospitals automate eligibility determination and charity care applications, patients receive the support they need promptly and efficiently.

Waystar uses PARO, a socioeconomic predictive model that considers the barriers that prevent 25-40% of patient-pay patients from applying for financial assistance. As a presumptive charity model — a last-resort approach for those who are unresponsive — it can be applied:

- Prior to bad-debt assignment to ensure all patients are assessed

- As a one-time reclassification for accounts currently sitting in bad debt

- At the point of service to identify accounts that will likely qualify for assistance and should be triaged to exhaust other funding sources before going to charity care

Once activated, Waystar’s Charity Screening solution can instantly help:

- Streamline financial processes

- Reduce administrative burdens

- Improve access to care for vulnerable populations