Note: This post was originally published in August 2022. It was updated in January 2025.

When it comes to coverage detection, how much insurance is slipping through the cracks?

As medical plans become increasingly complex and ambiguous, patients and providers face challenges. Many patients are confused by their coverage, or unaware they have it at all. For staff, limited bandwidth and the lack of supporting tools — in addition to receiving inaccurate information from patients — make it difficult to bill the right payer first or know when to collect from the patient.

Your organization likely has its own strategy in place to identify patient coverage and work through obstacles. However, if you’re using an inefficient or highly manual process, you could be letting crucial dollars go uncollected.

What is manual coverage detection costing you?

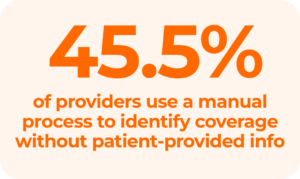

Relying on staff to find active insurance manually can drain resources and slow down your revenue cycle. Consider these challenges:

- High costs and inefficiency: Tracking down missing or unknown insurance is time-consuming, expensive, and high-touch

- Increased denials: Hidden or inaccurate coverage is a leading cause of denials, delaying reimbursement and extending days in AR

- Human error: Trying to find active insurance by phone or online increases the risk of errors and likelihood of overlooking billable coverage

- Burden on staff: Manual verification adds administrative pressure, especially with staffing shortages at an all-time high

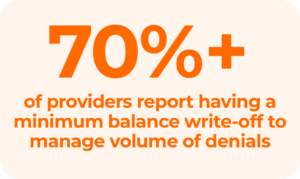

Is hidden coverage creating more bad debt?

With out-of-pocket costs rising, many providers say they have written off expenses to cover the cost for patients who cannot afford to pay their bills. Without insurance, much of what is owed by self-pay and uninsured patients is never realized. However, a pattern of uncompensated care can have a major effect on your bottom line and even negatively impact the patient experience.

Many self-pay and uninsured patients have hidden medical coverage that you — and they — are unaware of. In fact, up to 40% of self-pay patients have full or partial coverage that they know nothing about.

How does this happen?

- Some patients may be covered by more than one insurance company or government agency

- Others may qualify for charity care, disability coverage, or workers’ compensation, providing alternative ways to lessen their financial burdens

Get compensated for care

Educating patients about their coverage and having transparent discussions about cost goes a long way to gain trust. Combining these conversations with smart automation ensures you capture every opportunity to identify billable insurance.

Are self-pay and uninsured patients impacting your bottom line?

Did you know that it’s twice as expensive to collect from patients as from payers? According to recent CDC data, millions of people across the country lack insurance coverage.

But advanced technology can help RCM teams:

- Find missing or hidden coverage in real-time, before the patient leaves the building

- Resolve self-pay accounts in-house, eliminating the need to outsource

In addition to helping patients, this will also give you more control over collections, save time, and decrease days in AR.

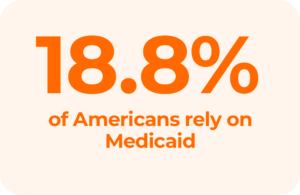

How seamless is your Medicaid claims process?

Nearly 19% of the U.S. population relies on Medicaid, which can introduce unique challenges. As a best practice, your team can consider Medicaid as the payer of last resort, making sure to investigate all other coverage options first.

Why? If Medicaid is filed when other coverage exists, it costs your organization time and money to process the claim — just to have it rejected. With fewer days left for re-processing within the timely filing window, inappropriately billing Medicaid can also add extra costs to the process and reduce revenue, causing a double hit to your revenue cycle.

Find coverage before filing Medicaid

Rich payer connections and smart technology can help you navigate the complexities of Medicaid and maximize your returns. At Waystar, we leverage more than 1,200 payer connections through our platform to surface hidden coverage in more cases.

Are you using the right tools to boost efficiency + minimize manual work?

In addition to inefficiency, the wrong tools can lead to missed opportunities and slower cash flow. Switching to an automated solution offers benefits including:

- Real-time insurance detection: Verify eligibility and uncover coverage instantly to minimize delays

- Improved efficiency: Purpose-built automation reduces administrative burdens, allowing staff to focus on tasks requiring human intervention

- Accelerated reimbursement: Streamlined processes lead to faster collections and fewer denied claims

Team up with a partner who delivers precision, accuracy, and results.

Does your current vendor check these boxes?

- Utilize extensive, accurate data rather than rely on limited or outdated third-party databases

- Provide a confidence rating for coverage results so your team doesn’t waste time double-checking

- Enable pre-claim coverage detection to ensure claims are accurate before submission

- Offer real-time coverage detection to identify billable coverage at the time of service

- Automate coverage detection across the revenue cycle to reduce denial risk at every stage

Calculate: How does your organization measure up?

Use our Coverage Detection calculator to see how much you could save in minutes. Uncover hidden revenue and put these strategies into action with the power of Waystar’s Coverage Detection solution — so you can focus on what matters most: caring for patients.