This is the seventh post in a new Waystar blog series: 7 steps to sharpen your healthcare revenue cycle.

Can’t wait for a new blog each week? Download the eBook to learn 7 steps for maximizing your healthcare RCM software.

Maximizing patient collections in healthcare is an increasingly common — and critical — goal. When a significant amount of revenue comes directly from patients, you need to fine-tune every piece of your collections cycle.

While it’s ideal for providers to collect payments at the point of service, that’s not always possible. For many encounters, post-service collections may be the only opportunity to collect, so it’s critical to design this effort for success.

Here are four steps you can take now to fine-tune post-service collections.

boosting patient collections in healthcare STEP:

1. Seize opportunities for integration

Many patient-facing transactions can be fully integrated into your systems without any manual intervention.

- If a patient has allowed their payment information to be stored, use that to automatically process any remaining responsibility.

- If a service is rendered to a patient who doesn’t have coverage or a payment method on file, automatically transmit that statement to the guarantor on file in real-time.

- For an insured patient, as soon as the claim is adjudicated, route the patient’s responsibility into the statement process to the guarantor of record.

- Transmit these invoices to the guarantor through a text message, or the patient portal.

On the patient side, you can also automate collections to allow patients to pay via smartphone or online.

To reduce your administrative load further, give patients a self-service payment-management system that allows them to view and pay past bills without any intervention on your end.

boosting patient collections in healthcare STEP:

2. Tighten your collections schedule

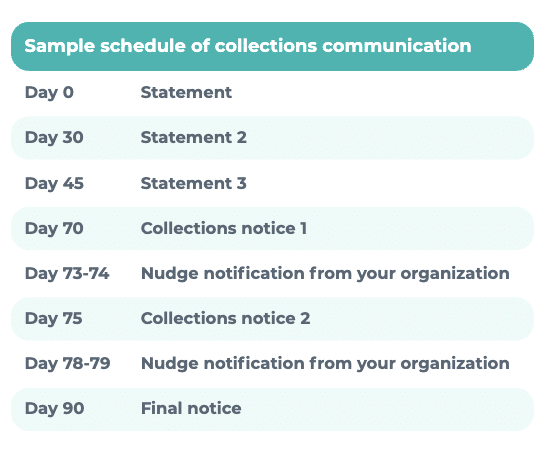

If your statement cycle is based on arbitrary factors like the alphabet, you’re building delays into your process. Create a statement cycle that starts as soon as patient responsibility is established, and work toward the goal of tightening collections to 90 days (or less).

After the initial statement on day zero (0), transmit two more statements, followed by a collections notice at 70 to 75 days. Combine the notice with a “nudge” notification from your organization within three to five days.

Specify a due date on all statements, including your final notice. Stick to what your notices declare and perform each step in accordance with your announced intentions.

Additional options:

- Some organizations have shortened the billing cycle even further by eliminating one of these statements. Instead, they send only two statements and one collections alert.

- Others have migrated from a 30-day cycle to a twice-monthly cycle to mimic patients’ receipt of paychecks.

boosting patient collections in healthcare STEP:

3. Choose a collections partner wisely

When you’re working with a collections agency, look for a partner that allows you to:

- Define your own terms

- Communicate seamlessly

Spending days each month preparing accounts for collections and the receipt of funds is a drain on your time. Any interface a partner proposes should be automated and bi-directional. Some RCM partners will even offer comprehensive reporting on third-party agencies so you can measure their performance.

boosting patient collections in healthcare STEP:

4. Don’t forget about financial hardship

A well-rounded, fair collections process must include a financial hardship policy.

- Develop a protocol to discount accounts — even up to a 100% adjustment, in some cases — based on a patient’s ability to pay.

- Determine the details of your application process.

- If you can, respect existing determination of financial hardship to the patient by organizations such as a community hospital.

- Seek the advice of an attorney when rolling out your hardship policy.

- Above all, apply your policy consistently.

Want to know more about sharpening your rev cycle?

- Read all the blogs in this series

- Watch the webinar with Dr. Elizabeth Woodcock

- Download the complete eBook