This is the second post in a new Waystar blog series: 7 steps to sharpen your healthcare revenue cycle.

Don’t want to wait for a new blog each week? Download the eBook to learn 7 steps for maximizing your healthcare RCM software.

Your revenue cycle begins long before a patient walks in the door. While many organizations fail to recognize it, the starting line is payer contract management.

Once you sign a contract — or fail to do so, kicking the contract into ‘evergreen’ mode — the race starts. If that happens and you haven’t properly reviewed or negotiated your payer contracts, how can you expect an optimal result?

Instead of getting overwhelmed, start with the basics. Make sure you understand:

- The payer’s prices (“the allowables”)

- The terms of the contract

Then, work your way through these seven steps for optimal payer contract management.

PAYER CONTRACT MANAGEMENT TIP:

1. Get granular with pricing

Let’s start with a question: Is it good enough to know that the payer reimburses you a certain percentage of the Medicare rate? The answer is no. The rate that payer is using may be a percentage of the current year’s Medicare rates — or it may be the schedule from 2022 … or even 2002.

In order to understand your reimbursements, you need specific prices — including the impact of modifiers and multiple procedures. Many states have laws to support transparency efforts, so seek counsel from your state medical society if you have trouble getting this information.

PAYER CONTRACT MANAGEMENT TIP:

2. Pin down terms + targets

Value-based contracting often comes with confusing terms.

- Some contracts rely on withholds: A portion of your expected payments are held and only released when certain conditions are met.

- Other contracts extend remuneration in the form of bonus payments, bundled payments, or a risk-based distribution.

- Others still may involve experience measures or utilization targets, such as:

- Unplanned readmissions or emergency department (ED) visits

- Closing gaps in care

- Managing the rising risk (patients who are at risk for a chronic illness)

Because of all these moving parts, it’s crucial to know which patients are being measured. Attribution is often a black box, which makes it difficult to focus on managing patients and hitting targets for full payment.

Unsurprisingly, payers won’t help you solve these problems — no payer is going to call you up and tell you that they mistakenly underpaid you.

It’s up to you to:

- Bring together contracting and revenue cycle teams.

- Determine the mechanics of value-based payment.

- Create a monitoring plan to ensure you’re getting paid what you deserve.

PAYER CONTRACT MANAGEMENT TIP:

3. Project + compare

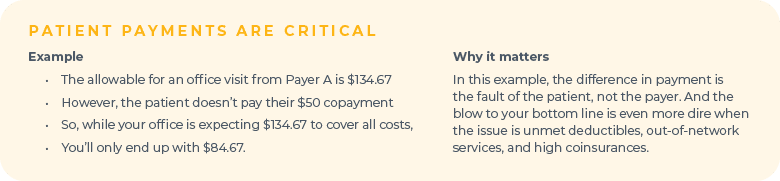

Once you determine what payments you expect, compare that with what you are receiving.

Identify any unexpected variances. In addition to payer-reimbursement challenges, you may discover payment gaps resulting from the patients’ failure to pay. That should alert you to lean into collections.

PAYER CONTRACT MANAGEMENT TIP:

4. Perform a cost analysis

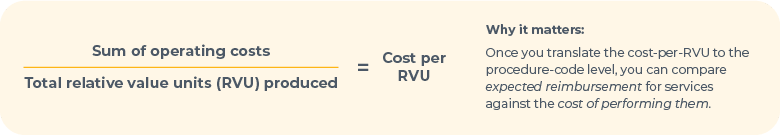

Next, drill down to the health-plan level and compare your results to a cost analysis.

What does it cost you to deliver these services? While it’s wonderful to set up a sophisticated, designated cost center, you can also benefit from a simple cost-per-RVU analysis.

PAYER CONTRACT MANAGEMENT TIP:

5. Assess the “hassle factors”

Once you’ve assessed your contract, pull data that’s specific to the administrative burden connected to each payer. Good indicators of this burden are the percentage of:

- Services the payer requires to be authorized

- Charge line items that the payer denies on first submission

- Appeals that are rejected

Any information you can gather about these and other hassle factors is helpful in determining your future relationship with that payer (including whether you should have one). There’s also the option to use an automated solution for payer remittance, which alleviates (and may even end) these hassles.

PAYER CONTRACT MANAGEMENT TIP:

6. Don’t forget the fine print

Finally, make sure you understand the current terms outlined in the contract, such as termination, filing deadlines, and recoupments. If you don’t have time to pull this together, consider hiring an intern.

PAYER CONTRACT MANAGEMENT TIP:

7. Act

In today’s competitive environment, this last step is the most difficult one; it’s also the most important.

Armed with new business intelligence, your organization must take steps to mitigate financial risk. In the past, organizations may have been successful at negotiating higher rates. While large organizations may still find success that way, negotiations are often tougher today given the consolidation of payers in the last decade.

However, there are still opportunities to leverage your new business intelligence:

- Report anomalies, as appropriate, to the insurance commissioner or advocacy channel.

- Assess the terms of the contract — an extension to the filing deadline, for example — to improve the relationship.

- When a payer introduces a risk-based contract, use your research to negotiate a more nuanced deal.

Finally, before you hire another practitioner, review these relationships. Make it known that you’re asking tough questions like: Is a better way to address high demand to drop a payer altogether? Given the short supply of providers in most communities, the payer may return to the negotiating table with a better deal.

Want to know more about optimizing your rev cycle?

- Read all the blogs in this series

- Watch the webinar with Dr. Elizabeth Woodcock

- Download the complete eBook

Want to know more about Waystar?