Healthcare organizations need to simplify patient payment collection — that’s how your patients see it anyway.

Whether they’re buying a new refrigerator or moving into a new house, they know what they’re going to pay today, the amount, and the number of future payments. Even retailers like Amazon and PayPal are beginning to offer payment plans and easy ways to see payment plans.

So why do people feel like they’re lost in a labyrinth when looking for answers about the cost of their healthcare services? And why are they still getting bills six months after the visit? Or a year? Or longer in some cases?

For your healthcare organization, helping patients understand their financial responsibility up front — and the options to pay for it — should be a top priority. And doing it right can have positive implications on other top priorities, like cost management, labor productivity, and the well-being of your workforce.

STRATEGY #1

Cut patient payment collection complexities

Most people don’t understand the intricacies of patient payment collections on the backend. They just want transparency about their bill.

One healthcare revenue cycle leader set out to find out why this is so complicated — and how to fix it.

“Through the lifecycle of the patient, the bill is the last thing that they get, and it can really ruin their experience. So helping them understand and go through that journey is meaningful,” said Jodianne Broomall, VP of Revenue Cycle at Cincinnati Children’s.

According to Broomall, when you look at patient payments, it’s important to look at the complete continuum of the patient financial experience (PFX) starting with early communication.

This is harder than it sounds. Cincinnati Children’s Hospital accepts transfers from every state in the nation. When an out-of-network patient is transferred to the hospital from another state, the conversation is primarily between doctors.

Broomall’s vision is for someone on her team to communicate directly with the family, so they understand their costs up front, prior to the transfer. With smart software powered by automation and AI, her team can quickly verify eligibility, screen for charity care, and provide accurate patient estimates.

STRATEGY #2

Ward off auth-related denials

Denials are climbing every year, leaving a bad taste in patients’ mouths. If they receive surprise bills months later, it can lead to feelings of dissatisfaction with the provider. And health organizations risk leaking millions in revenue.

As part of her strategy to simplify patient payments, Broomall is looking to break down the walls that denials put between the hospital and patients.

During a 9-month discovery process, “frustrating data” revealed that no-authorization denials for inpatient services cost Cincinnati Children’s $40 million over two fiscal years. This tracks with recent research that finds the biggest cause of denials stems from prior authorization errors, causing 39.7% of denials.

And, Broomall found that only around 1% of those denials were overturned.

“All of this rework means it takes a lot longer to get the claim paid and get the actual bill to the family,” Broomall said. “It took us down this journey of figuring out how to do it right up front so the authorization wasn’t denied.”

Broomall realized authorizations were happening “all over the hospital” by team members like clinical nurses and managers.

“We’re bringing that work back into finance where it belongs so we can get it done right, decrease those denials, and take stress out of the system,” Broomall said. “We aim to hold the payers accountable for our patients.”

In addition to centralizing RCM tasks in the finance department, Broomall is looking to automation to help get every step of prior authorization right, starting with identifying the right coverage — or even hidden coverage — up front.

Strategy #3

Include patient financial experience in your KPIs

While health organizations like Cincinnati Children’s are beginning to realize that the patient financial experience goes hand-in-hand with a patient’s well-being, there are business reasons to focus on the patient experience, too.

“In really competitive markets, patient satisfaction is a big one with people making decisions about where to receive care,” says healthcare industry expert Tomi Ogundimu, who previously served as Vice President of Research & Education for The Health Management Academy, a community focused on improving healthcare.

Additionally, high deductible insurance plans mean patients are paying more upfront for healthcare — and paying more attention to costs.

Meanwhile, 60% of finance leaders say patient experience is a priority, but a mere 3% of them are very satisfied with their PFX processes.

The research also suggests that patient experience initiatives lose ground to competing organizational priorities such as cost management, staff well-being, and the drive to reduce administrative burden.

Ogundimu acknowledges that patient experience is considered a “soft KPI.” But she argues that it leads directly to success in those competing priority areas — or “hard KPIs” — down the road.

“Think back to the nurse chasing prior auths,” Ogundimu continued. “What are they not doing? How does that affect hard metrics in six months?”

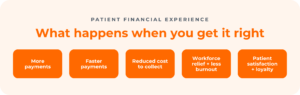

A strong PFX strategy supported by smart patient payments software can give hard metrics a boost by:

- Yielding more payments, faster, and reducing the cost to collect with improved patient engagement

- Curtailing staff burnout and allowing for a personalized financial journey by providing accurate estimates and self-service payment tools

- Enhancing efficiency and security by using process automation and consolidating RCM vendors

STRATEGY #4

Automate to support PFX + manage costs

Amidst competing priorities and resource constraints, the case for automating the revenue cycle is gaining significant traction.

Automation software can make an outsized difference in areas like cost management, labor productivity, patient payment collections, and every other function across the revenue cycle.

Ogundimu sees opportunities for automation across the revenue cycle, including in processes like authorizations and denial prevention, allowing healthcare providers to redirect recaptured time to patient care.

“It really makes sense to pull these tasks back into finance where they belong,” she says.

Broomall agreed, saying, “When you look at the labor cost, authorizations were being done in clinical areas. Why am I paying a nurse to do an authorization? Or a care manager? They need to be caring for patients. So, automation was a choice we made to make sure those costs were in the right areas.”

Ogundimu points out the opportunity for using automation to prevent denials, which increased by 67% in 2022 according to HealthLeaders Media. Smart RCM software can help providers capture revenue faster and more fully, strengthening their billing and budget cycles.

“So when a CFO’s biggest priorities are to figure out labor cost management or to manage the workforce crisis and they say they don’t have time for automation, the case for automation is actually really strong at capturing both of those goals,” she says.

STRATEGY #5

Find a trustworthy patient payment collection partner

Automating your rev cycle to provide a superior patient financial experience will bring change to your organization. It’s worth it, because every patient is impacted by the revenue cycle, even if they don’t see the behind-the-scenes complexities of prior authorization and denial prevention.

“So many healthcare providers tell me their partners promised them things that didn’t happen,” says Ogundimu. “At the end of the day, there needs to be a rebuilding of trust between health systems and partners who do what they say they can do.”

If you’re considering automation, you don’t want to end up lost in another labyrinth. Ogundimu and Broomall offer characteristics to look for in a partner:

- Honesty: Partners need to be open about what they can and cannot do. Trust is huge.

- Expertise: You need a thought partner, not just a tool.

- Value alignment: Does the partner share your values? Do they care about what they’re doing?

- Teamwork: They must be upfront about who is responsible for what during an implementation. And be available before, during, and after implementation for support.

- Timing: How much time does it truly take to implement?

Navigating the healthcare payment maze

If you’re exploring automation to support PFX across your revenue cycle, selecting the right partner can make or break your success. Below are some additional resources that can help guide you through the complexities of healthcare payments:

- Get the full THMA research report on how investing in PFX can yield powerful results in your revenue cycle.

- Access this helpful checklist to help you frame the conversation and choose the partner with the right attributes for working with you and your team.

- Read our comprehensive eBook: 4 strategies to help your team + patients break through the billing haze.